They must score at the very least 45 for every cent aggregate marks within their last qualifying examination. For reserved category students, there could possibly be some leisure within the combination rating.

Students need to occur clear of the course with a substantial working understanding of how IP is built-in into basic and State-of-the-art tax transactions, what are the recent areas for IP tax planning, and how to place difficulties concerning IP property in multinational organizational structures.

These credits are then utilized to offset towards Australian tax paid on the same volume, yet again guaranteeing income is simply taxed the moment.

Capital gains are included in taxpayers’ assessable income and therefore taxed at Every single taxpayer’s applicable income tax charge (see beneath, Taxation of Individuals).

For those who feel that our information does not totally deal with your instances, or you might be Not sure how it applies to you, Call us or find Specialist information.

Graduates of The 2-Year Tax system may perhaps seek out to remain in The us for a stretch of time following graduation—as permitted under visa regulations—to get functional do the job encounter in a very firm, company, or other organization.

A prospect need to meet up with minimum eligibility standards so that you can acquire admission for the DTL course. The eligibility conditions could vary from faculty to college. Nonetheless, the regular eligibility standards is mentioned underneath:

The tax collector is also referred to as a here Revenue Officer. A tax collector is accountable for trying out the economic information, having subject audits, and preserving bookkeeping information.

Lots of Point out and Territory taxes and obligations are usually not consistent in the course of Australia and therefore the laws applicable in Every jurisdiction has to be regarded exactly where related. The taxes and duties talked about below nevertheless indicate some common varieties of state taxation.

Residence tutors are the one that teaches students in their residences. By choosing for this job candidates can teach taxation like a subject matter to your students.

The course also discusses U.S. Constitutional constraints applicable to Sales & Use taxes and point out attempts to bypass these limitations. Finally, We are going to go over present troubles in the sector of Product sales & Use taxation, which includes application of Revenue & Use taxes to distant Digital commerce and marketplace facilitators.

Students unable to decide to the full focus in estate planning, but thinking about learning more about it, should really think about the following elective courses:

The works of Benjamin Franklin : made up of quite a few political and historic tracts not A part of any former edition and lots of letters official and private, not hitherto printed : with notes in addition to a lifetime of the creator by Jared Sparks.

These major colleges in India give you a Diploma in Taxation Regulation at a justified tuition charge though delivering substantial-paying out career opportunities after the completion on the course. Some of them are:

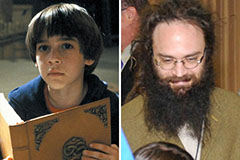

Barret Oliver Then & Now!

Barret Oliver Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!